Client Onboarding, Done Right: A Practical Guide for Financial Institutions

20.02.2025

Introduction

Client onboarding is one of the most sensitive and complex operations in any financial institution. Whether you’re a regulated bank or a niche investment firm, ensuring that clients are onboarded efficiently, securely, and in compliance with evolving regulations is mission critical.

But for many institutions, onboarding is still an overwhelming process bogged down by paperwork, repetitive data entry, Excel-based calculations, and scattered communication. The result? Frustrated teams, delayed onboarding, compliance risks, and poor client experiences.

This post explores how Emakin can help digitise and automate client onboarding — with the flexibility to handle both simple and highly complex requirements.

1. Eliminate Paper-Heavy and Email-Driven Workflows

The traditional onboarding process relies heavily on paper documents, scanned files, and long email threads. Teams chase clients for signatures, checklists, and missing data. Everything is done manually, and there’s little structure to guide the flow.

With Emakin, all onboarding data is centralised in one secure platform. Clients can upload documents, answer structured questions, and complete checklists via a guided digital interface. Internal teams collaborate in one place, rather than across disconnected email chains. This not only speeds up onboarding but also ensures all required data and documents are collected correctly the first time.

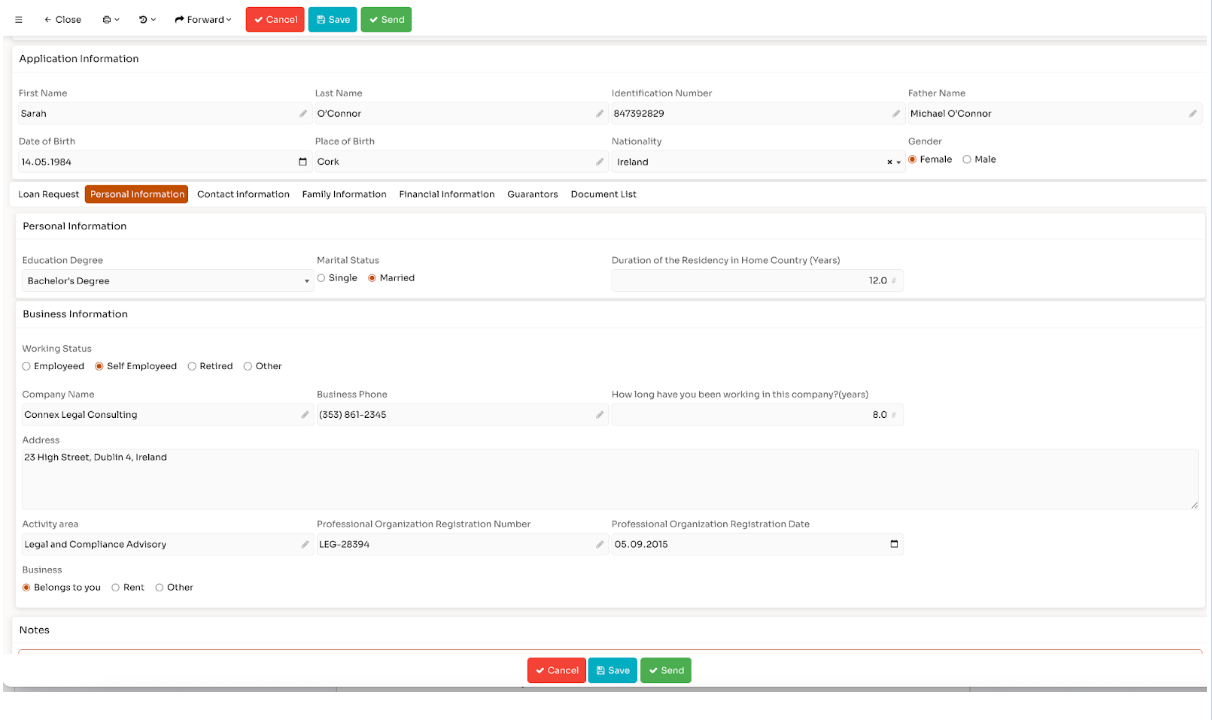

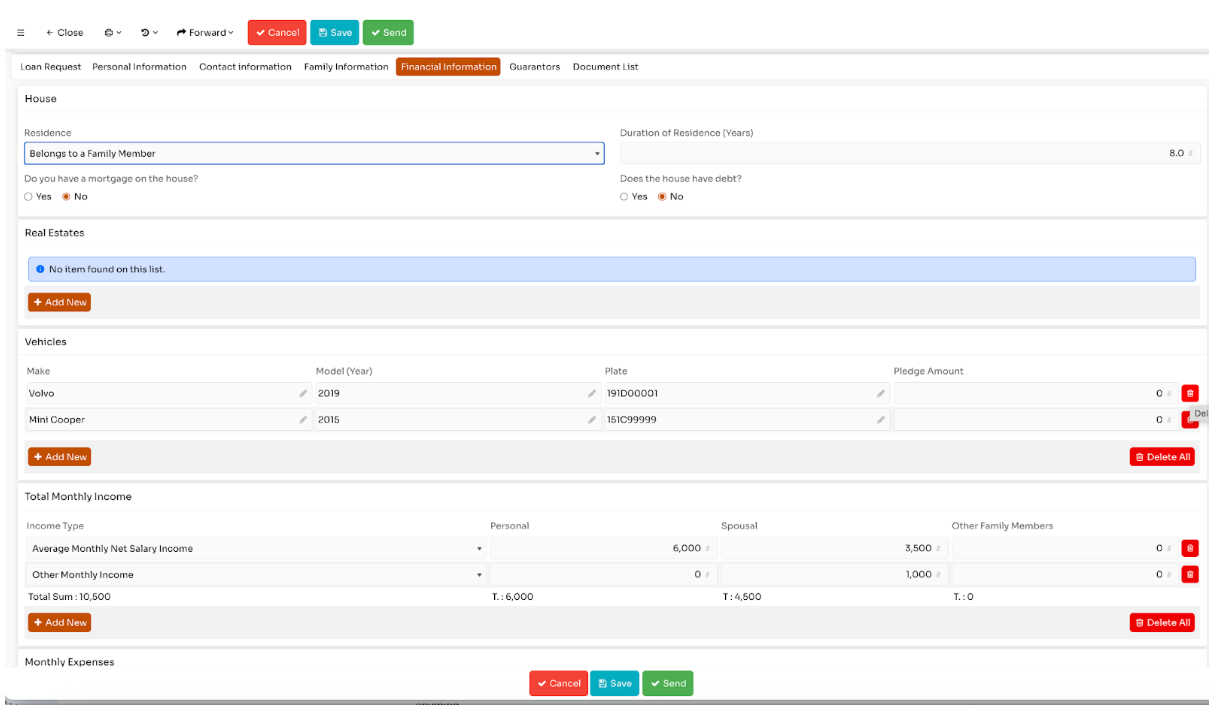

2. Stop Re-Entering the Same Data Again and Again

Most institutions collect the same client data multiple times during onboarding, periodic reviews, and compliance checks. Staff waste hours re-typing names, addresses, risk scores, and financial details into various spreadsheets or systems.

Emakin solves this by creating a single source of truth for each client. Data entered once is reused throughout the entire lifecycle — whether during the initial onboarding, an annual review, or a transaction monitoring event. Smart forms pull in existing data where applicable and only request what’s truly needed, saving time and reducing the risk of errors.

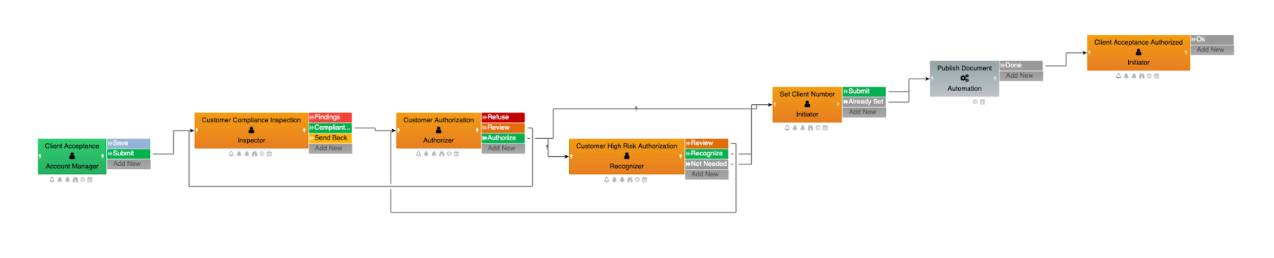

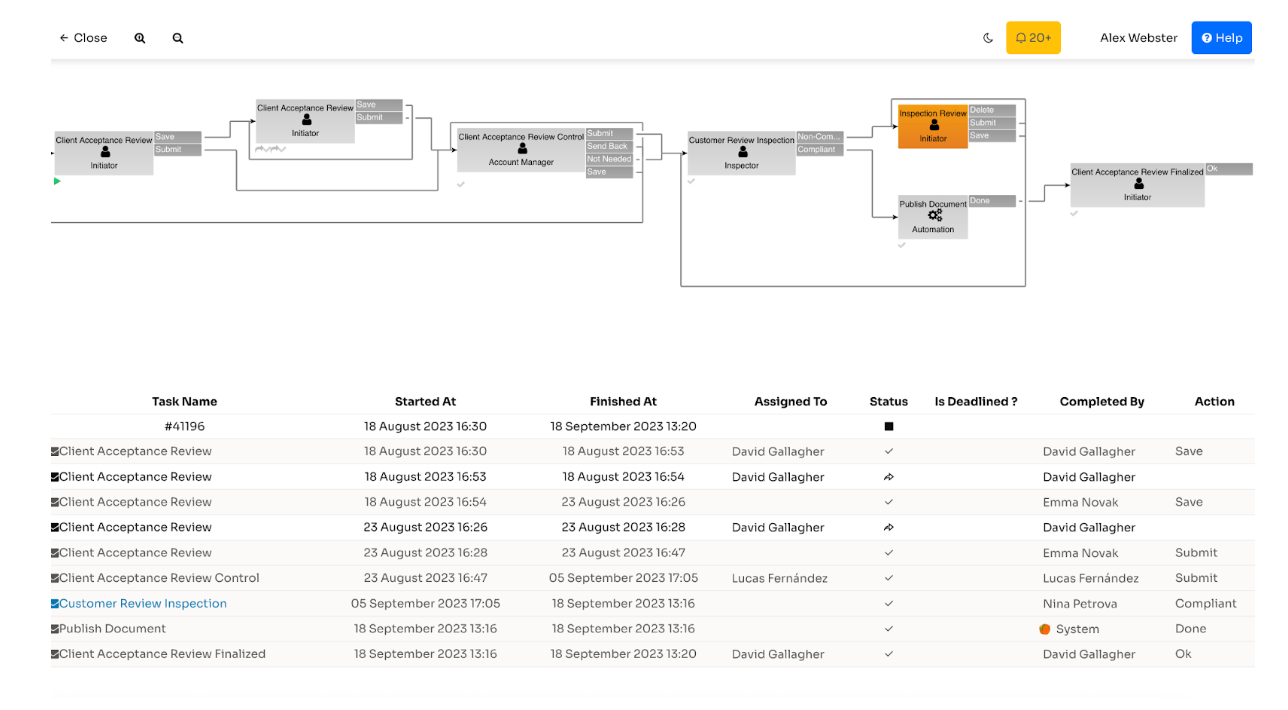

3. Enforce Strict Workflows That Run Like Clockwork

In most organisations, there’s a big gap between how onboarding should work and how it actually happens. Without a system enforcing the rules, steps are skipped, documents are missed, and reviews are delayed — sometimes knowingly, sometimes not.

Emakin changes that. Every onboarding workflow is clearly defined and enforced by the system. Steps only become available when prerequisites are met. The platform guides users step-by-step, so even new employees can follow complex procedures without missing anything.

This eliminates human error and ensures the entire process is auditable and consistent. It also reduces training overhead, since the system itself shows users what to do next. For management, this means peace of mind that onboarding is done right — every time.

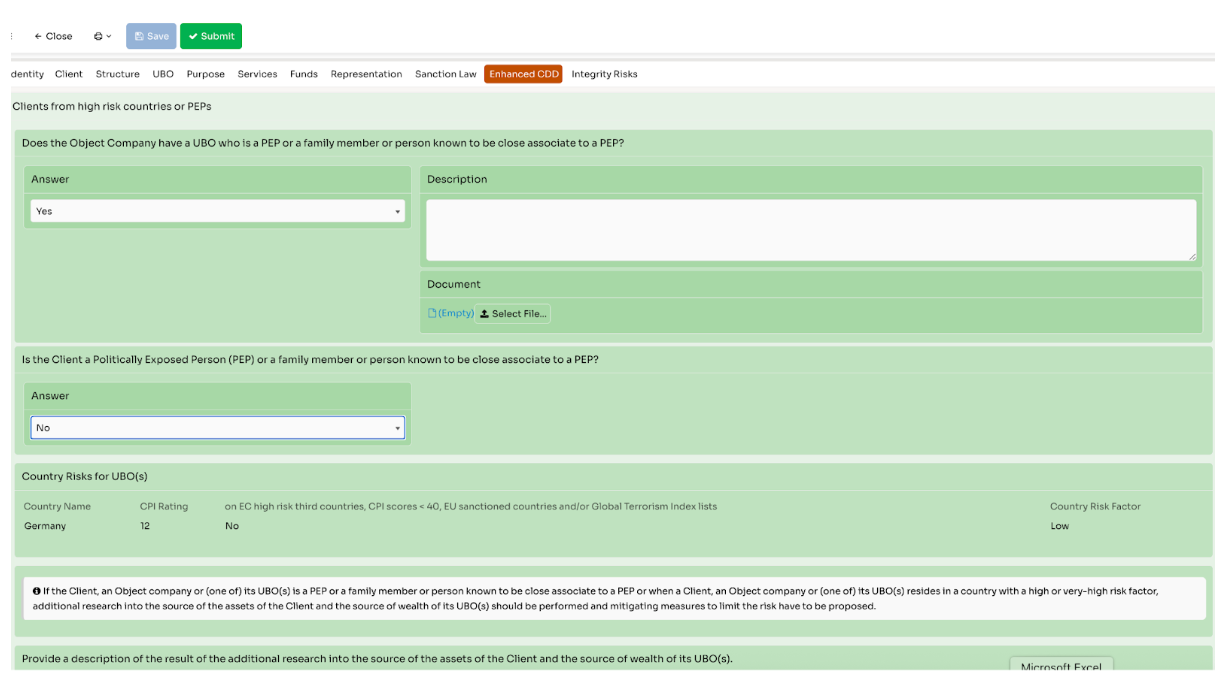

4. Built-In Screening & External Integrations

In an effective client onboarding process, identifying potential risks early is critical — especially in financial services. Sanction list checks, PEP (Politically Exposed Person) screenings, and internal blacklists all form part of a robust due diligence process. However, many organisations still manage these steps manually or as isolated, after-the-fact activities. This slows down the onboarding timeline and introduces significant risk exposure.

Emakin changes that by offering two powerful capabilities:

Seamless Integration with External Screening Services

Emakin can be integrated with a variety of third-party AML, sanctions, and PEP screening providers — whether local, international, or custom-built. When a new client, UBO, or related party is entered into the system, Emakin can automatically trigger screening actions behind the scenes. If a match is found, the process is halted or escalated according to your internal policy. And because the integration is real-time and event-driven, there’s no delay or risk of oversight.

Internal Screening Logic & Watchlists

For teams who prefer to manage screening workflows in-house, Emakin also allows you to build your own screening and validation logic. You can define internal blacklists, risk scoring rules, document validation checkpoints, or even recurring profile re-checks. This logic becomes part of the process itself — no need for external scripts or disconnected tools.

Whether you use external vendors or build your own validation rules, Emakin ensures screening is embedded directly into your compliance workflow — providing faster onboarding, safer operations, and peace of mind.

5. Smart Document Collection Based on Context

In traditional onboarding workflows, collecting the right documents — from IDs and business licences to risk disclosures or source-of-funds declarations — often involves dozens of back-and-forth emails. Files arrive in different formats, with inconsistent naming, missing data, or incorrect versions. It slows down compliance, burdens both clients and staff, and increases the risk of critical omissions.

With Emakin, this entire step is streamlined and centralised in a way that benefits all sides.

Guided Collection, Not Just Upload

Emakin doesn’t just provide a basic file upload function. The system dynamically guides users — whether internal staff or external clients — through a structured document collection flow. It asks the right questions, expects specific formats, and ensures that nothing important gets skipped. Each document is treated not just as a file, but as a profile — a structured container of both the file and its metadata.

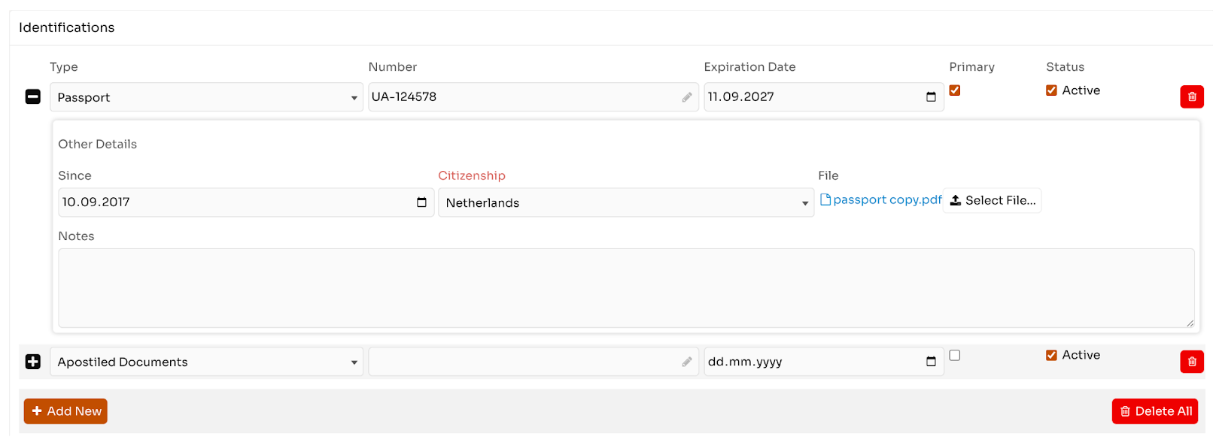

Document Profiles Adapt to the File Type

Every document type in Emakin can have its own profile with tailored requirements. For instance:

- If the user uploads a passport, the system will prompt them to enter the passport number, expiry date, and issuing country.

- If it’s a proof of address, Emakin might ask for the issue date, document type (e.g. utility bill, bank statement), and issuing institution.

- If it’s a business licence, fields like licence number, activity type, or validity period may be required.

These profiles allow for granular validation and eliminate the need for staff to chase missing or unclear information later.

Context-Aware Requirements

The system also adapts the document checklist based on client type, jurisdiction, or risk score. A corporate client from a high-risk jurisdiction may need to upload ownership charts, tax declarations, or third-party attestations — while a domestic individual client follows a lighter route.

This removes the guesswork for staff and ensures consistency across all locations.

Real-Time Validation & Notifications

Once submitted, documents are instantly validated and routed to compliance reviewers. If anything is missing or inconsistent, the system notifies the responsible party — no delays, no email chains, no inbox clutter.

Built-In Auditability

Every submitted document is timestamped, versioned, and linked to the client file, ensuring a fully auditable trail for internal and external reviews.

By treating document collection as a guided, intelligent, and rule-based step — not just a file upload — Emakin removes friction, enforces compliance, and reduces risk across the board.

6. Full Visibility & Control for Every Stakeholder

Whether you’re in compliance, operations, or management, one of the biggest frustrations is not knowing where things stand

in the onboarding process.

With Emakin, every stakeholder gets real-time visibility:

- Where each client is in the workflow

- Who completed what and when

- Which documents are missing or overdue

- How many cases are being reviewed, escalated, or are stuck

This isn’t just helpful — it’s critical when the pressure is on.

In complex banks, onboarding a corporate client often involves 7+ steps across departments: relationship managers, legal, compliance, and operations. There are documents to collect (like UBO declarations and incorporation papers), screenings to run, approvals to escalate — and each step needs tracking.

In smaller financial firms, the process is simpler but still needs structure: client intake, ID checks, risk review, and activation. Without a system in place, these steps easily get lost in email or spreadsheets.

Emakin adapts to both: showing exactly where each case stands, alerting users when they need to act, and giving managers the tools to step in when bottlenecks appear.

And because every step is logged, reports for internal use or external audits are always just a click away.

Emakin adapts to both scenarios and ensures everyone has the oversight they need. With click-to-export reporting and full audit trails, inspections and internal reviews become painless.

Conclusion

Client onboarding is the front line of compliance and customer experience. Getting it right means fewer delays, reduced risks, and stronger client relationships.

With Emakin, financial institutions can finally replace outdated, manual processes with a structured, secure, and scalable onboarding system — one that works seamlessly for clients, compliance teams, and management.

What sets Emakin apart is its flexibility. Requirements like the ones discussed in this post — from dynamic data collection to rule-based workflows, document profiles, and multi-stakeholder approvals — can be developed rapidly using Emakin’s powerful process automation platform.

You don’t have to wait for a product roadmap or rely on custom development. With Emakin, your onboarding process is built around your needs — not the other way around.

Let us show you what onboarding looks like when it’s done right.