Transforming Trust Management Through Smart Process Automation

How a trust and corporate services provider streamlined KYC, risk monitoring, and DNB audit readiness with Emakin.

Client Overview

Kiltoprak Bericorp Financiers Group NY is a trust and corporate services provider operating across the

Netherlands,

Switzerland, and

Malta. As a licensed entity under Dutch regulators like the

DNB (De Nederlandsche Bank), they face strict AML/CTF and due diligence obligations. With a growing international client base and rising transaction volume,

manual processes became a bottleneck, especially around ensuring

traceability, cross-border compliance,

and

audit readiness.

Challenge

Operating across multiple countries, Kiltoprak faced increasing pressure to strengthen its compliance infrastructure. Their client acceptance and transaction monitoring processes were mostly document-driven, relying heavily on email threads, manual file uploads, and disjointed review cycles. This posed several risks:

- Reliance on

email and documents for onboarding and reviews

- Difficulty enforcing

4-eye compliance and tracking approvals

- Inconsistent documentation across branches

- Limited visibility into review

statuses and risk indicators

- High risk of

non-compliance during DNB inspections

Sector:

Finance

Established:

2018

Headquarters:

Netherlands, Switzerland & Malta

Key Processes Managed in Emakin:

Client Acceptance, KYC, Transaction Monitoring, Compliance and more

Solution: Emakin’s Process Automation Platform

Kiltoprak implemented

Emakin to digitise and unify its entire compliance lifecycle — covering

client onboarding, transaction documentation review, ongoing monitoring,

and periodic reviews. What used to rely heavily on spreadsheets, email chains, and manual coordination has now been transformed into structured, collaborative, and audit-proof workflows, all within a secure EU-hosted platform.

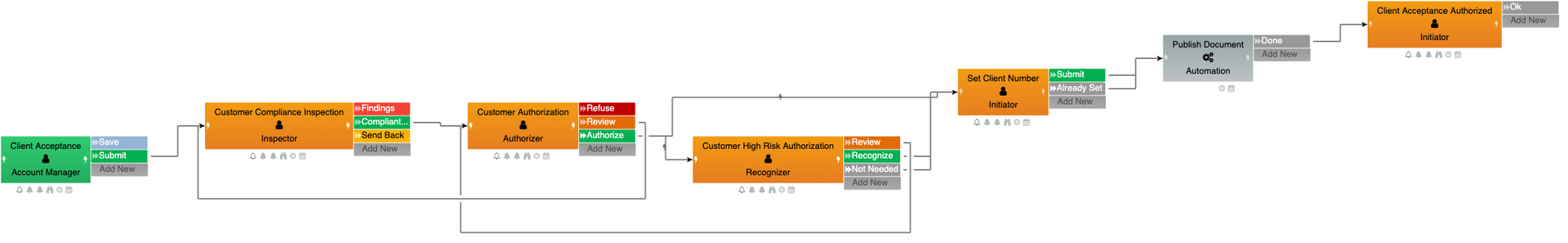

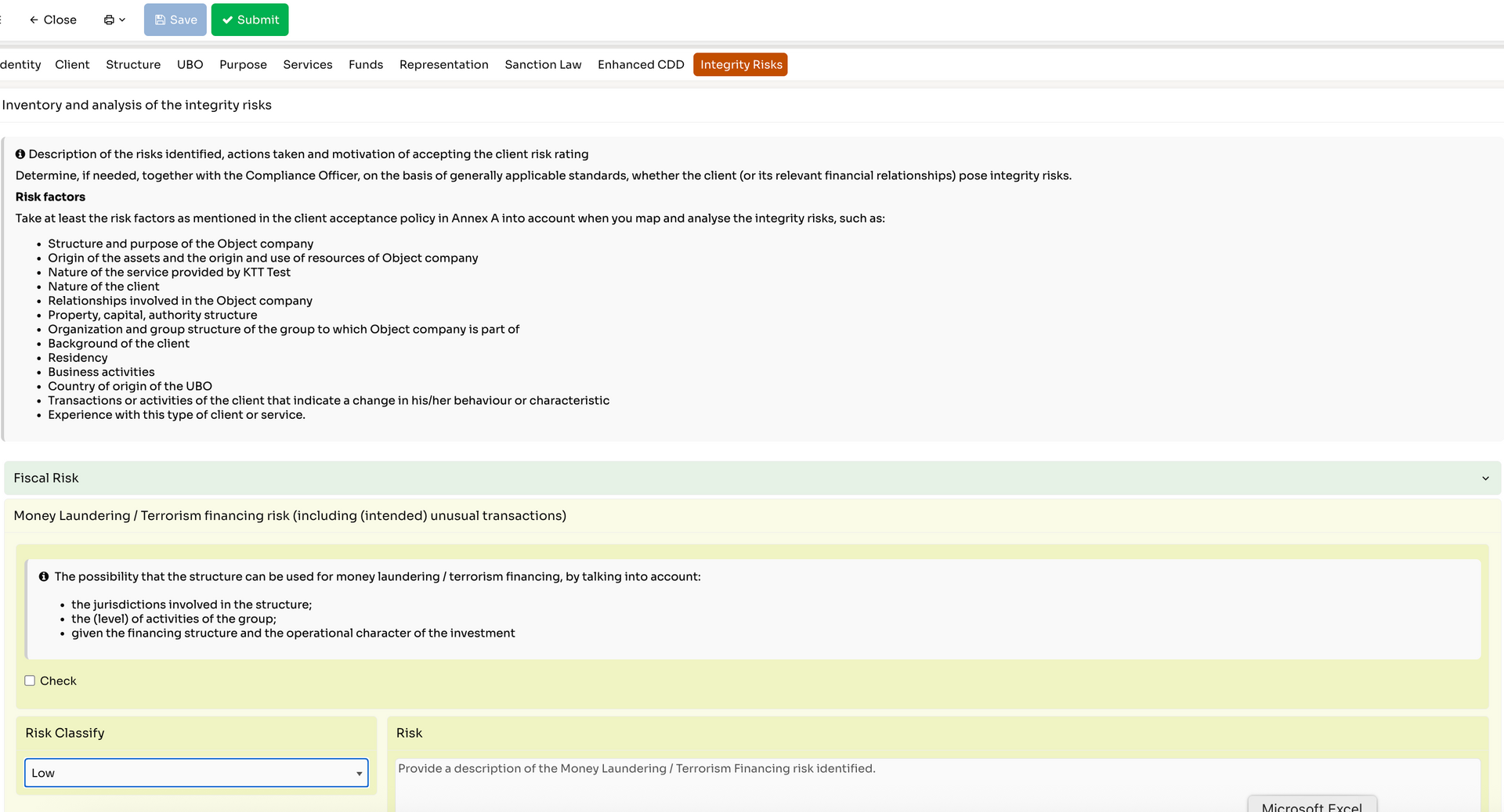

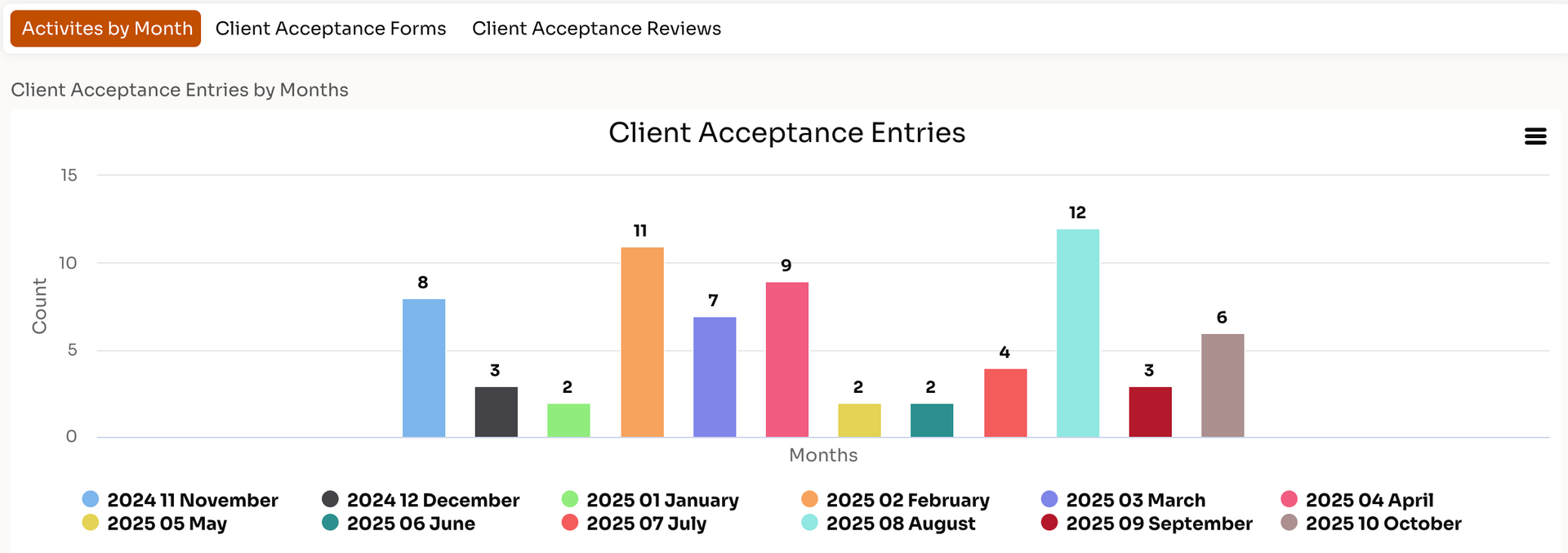

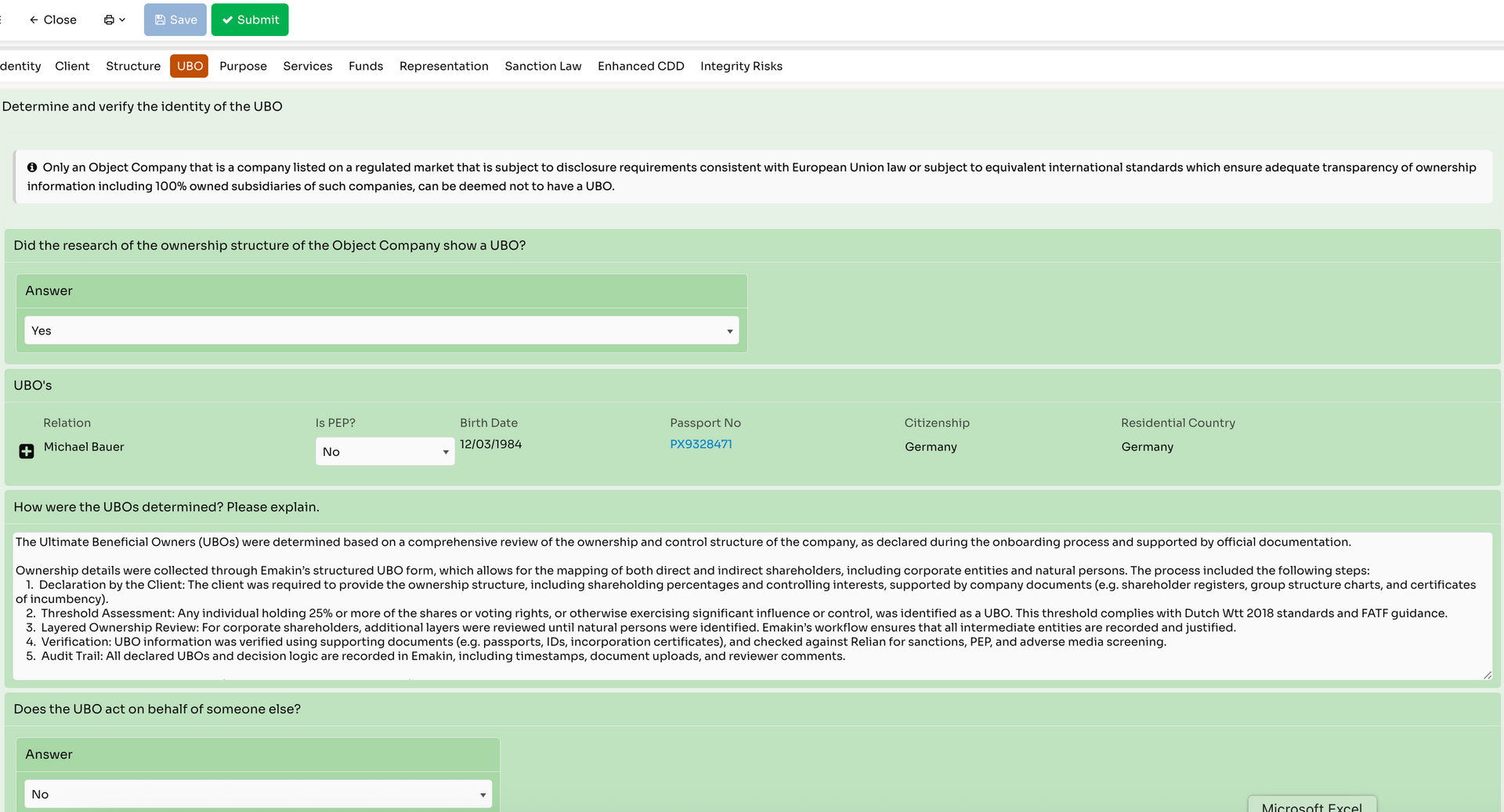

Client Acceptance & Periodic Review Automation

The heart of Kiltoprak’s compliance framework lies in the automation of its client onboarding and periodic review processes. These are fully digitised workflows involving multiple roles — including compliance officers, relationship managers, and senior approvers.

- Smart forms dynamically adapt based on

client type

(individual, corporate, trust), jurisdiction, or ownership structure. For example, selecting a high-risk jurisdiction will automatically reveal additional fields for enhanced due diligence requirements.

- The system automatically applies

conditional rules: high-risk clients are routed to senior management for approval, while low-risk clients follow a lighter path.

- Every case is logged in real-time, with complete visibility over who submitted, reviewed, or approved the data — ensuring traceability for internal reviews or Dutch DNB inspections.

This approach not only improves compliance outcomes but also significantly reduces back-and-forth communication between departments.

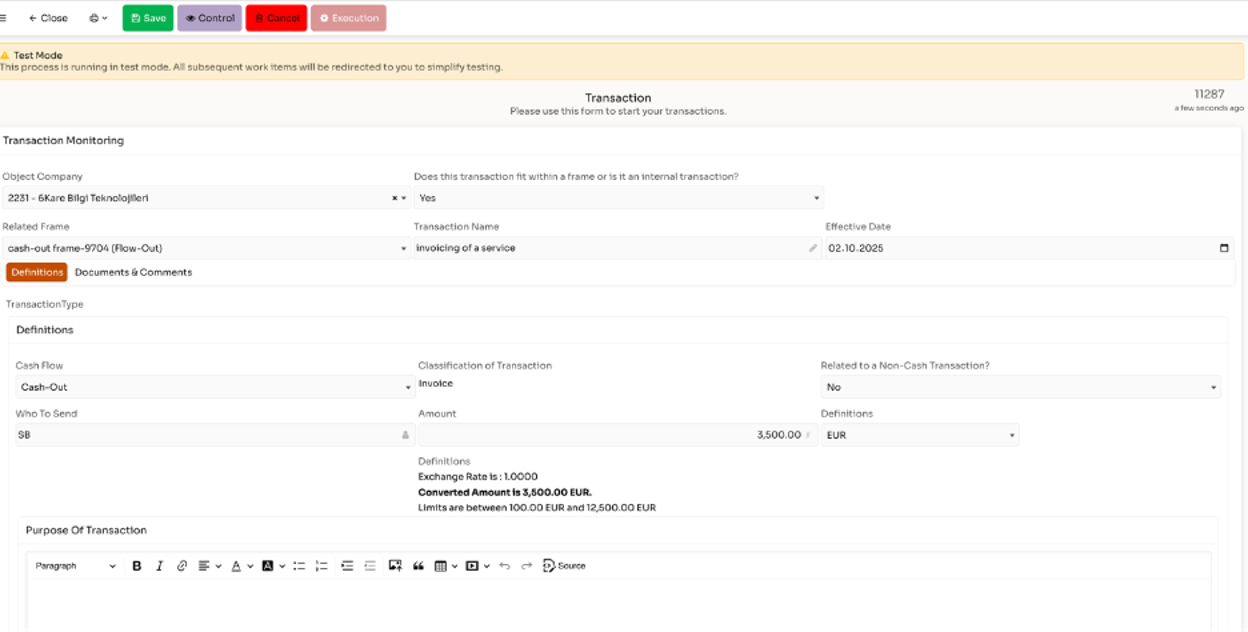

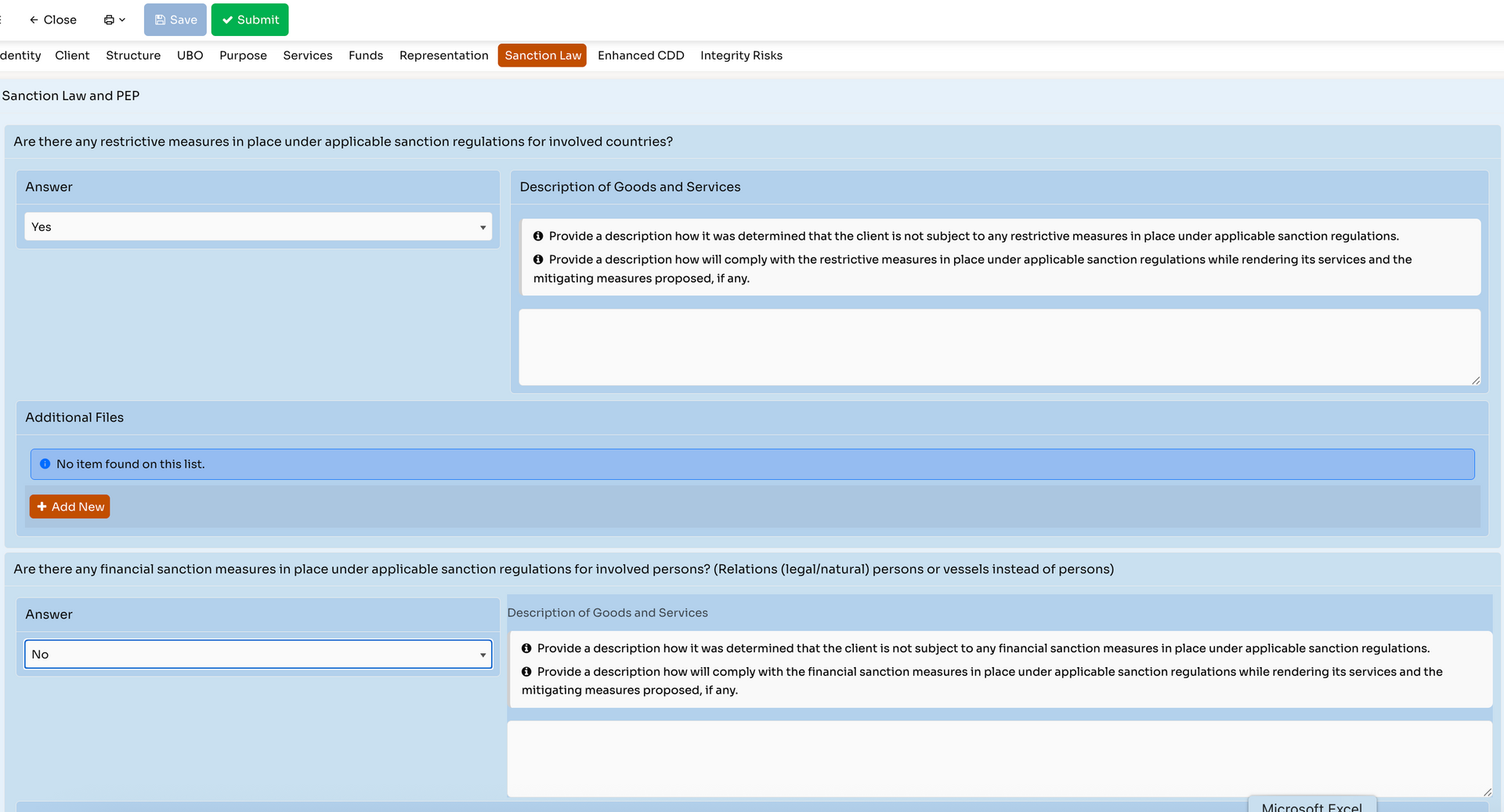

Transaction Monitoring Framework

Emakin is used not just for onboarding but also for logging and reviewing all client-related transactions. This has enabled Kiltoprak to build a risk-based monitoring layer that continuously assesses activity for anomalies.

- Transactions are

automatically categorised based on metadata such as

transaction type, counterparty country, amount,

and risk rating.

- Built-in rules identify

unusual patterns

or high-risk behaviours (e.g. transactions involving high-risk countries or exceeding typical thresholds), which are immediately flagged for compliance inspection.

- Each transaction log includes a justification field for reviewers to explain decisions, a comment log for internal communication, and built-in escalation paths when something requires further attention.

The entire process is structured, logged, and available for review or audit at any time.

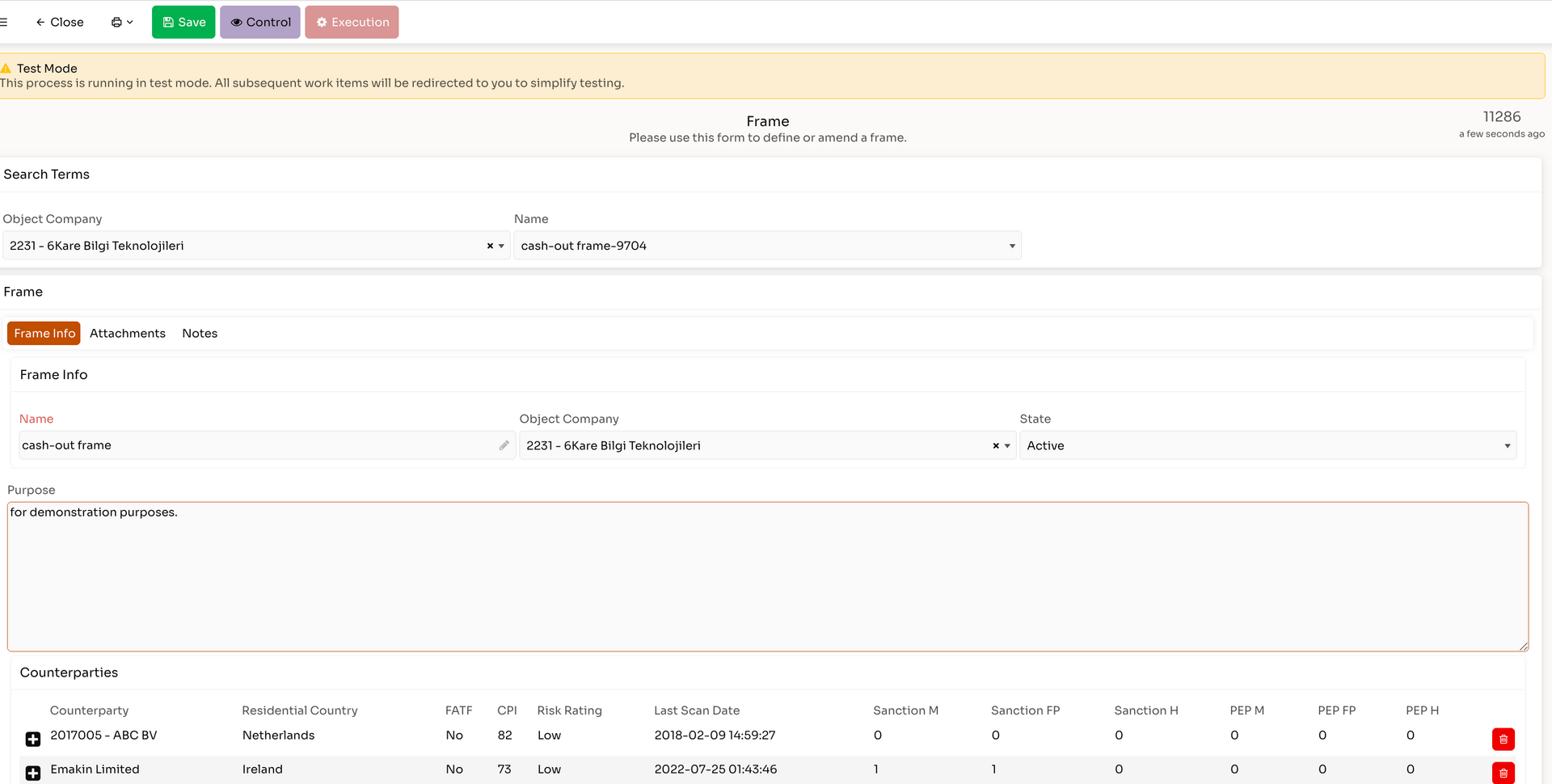

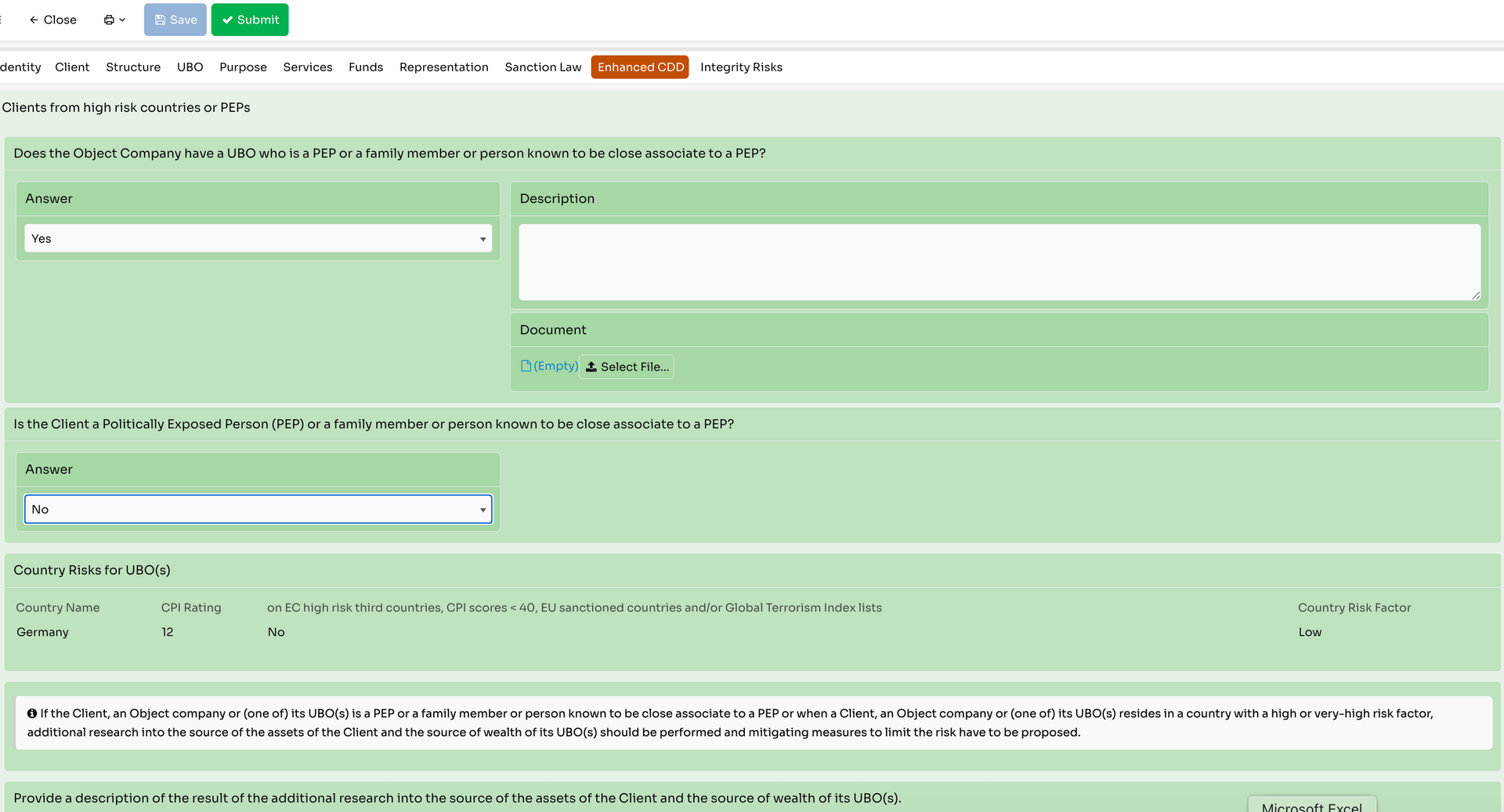

External AML/PEP Screening with Real-Time Sync

To ensure ongoing compliance with AML regulations, Emakin is tightly integrated with an internal tool, Kiltoprak’s external AML, sanctions, and PEP screening provider.

- As soon as a new

client, UBO,

or related party is created or modified in Emakin, the system triggers a

real-time screening request to Relian.

- Emakin performs

scheduled syncs with Relian’s database (e.g. daily), which ensures that existing parties are re-evaluated against the latest PEP/sanction lists.

- If a party becomes non-compliant due to a new listing (e.g. a UBO is added to a sanctions list), an instant alert is generated and assigned to compliance staff for immediate action.

This continuous screening process ensures that Kiltoprak can respond to threats as they arise — not just at the time of onboarding.

Risk-Based Workflow Logic

Kiltoprak’s processes adapt dynamically based on client-specific risk attributes, rather than applying a one-size-fits-all approach. This ensures both compliance with Wtt 2018 and efficient use of resources.

- Clients from

high-risk jurisdictions, with

complex ownership chains, or marked as

PEPs are automatically flagged and routed into

stricter workflows, which require higher-level approval and additional documents.

- Conversely,

low-risk clients benefit from a more streamlined process, reducing unnecessary workload and delays.

- The risk logic is fully configurable and easily updated as regulations evolve or as internal risk appetite changes.

This ensures regulatory compliance and operational flexibility without compromising consistency or control.

Audit Trail & Regulatory Reporting

Every action in Emakin — from form submission to approval or rejection — is recorded and timestamped, forming a complete audit trail of the compliance process.

- The system tracks

who did what, when, and from which location or device.

- Every case includes a

chronological view of all steps taken, including file uploads, comments, decisions, and communications.

- Reports can be generated on demand for Dutch DNB inspections, internal audits, or annual compliance reviews, including CSV exports or direct dashboards.

This level of transparency significantly reduces the overhead of audit preparation and allows Kiltoprak to respond to regulator queries with confidence.

Client Document Collection Interface

To eliminate inefficiencies from email-based document collection, Emakin provides a secure web portal for clients and external stakeholders.

- Clients are guided through a structured form to submit required documents — such as passports, declarations, or transaction confirmations — ensuring data completeness and standardisation.

- Automated

validation rules check file types, expiry dates, and naming conventions. For example, an expired ID will be flagged instantly.

- Compliance teams are notified automatically when submissions are completed, allowing them to begin validation without delay.

This not only saves time but also improves client experience by reducing email chains and redundant requests.

Web-Based, Secure, and EU-Compliant

Kiltoprak runs Emakin on a dedicated cloud environment hosted in ISO 27001-certified data centres in Ireland. The solution is fully aligned with GDPR and Wtt 2018 requirements.

- The system is

accessible via browser, with full mobile compatibility — making it ideal for hybrid or distributed teams.

- All access is controlled via

role-based permissions, and detailed logs show user activity and data access patterns.

- Since all data remains within the

European Economic Area, the platform meets the strictest standards for

data residency and privacy.

Scalable for Growth

Emakin isn’t just a one-time project — it evolves alongside Kiltoprak’s compliance and business strategy.

- Compliance officers or system admins can update forms, add new approval rules, or adjust risk profiles using Emakin’s

no-code interface.

- Previous workflow versions are

archived and version-controlled, ensuring traceability even after regulatory changes.

- Regular feedback from staff helps fine-tune the platform — turning it into a living system that gets smarter over time.

This agility means Kiltoprak can scale operations, onboard new jurisdictions, or introduce new risk frameworks without rebuilding their compliance infrastructure from scratch.

40

USERS

3

BRANCHES

60.000

TRANSACTIONS

Results

Kiltoprak achieved measurable improvements across its entire compliance operation after implementing Emakin’s Process Automation Platform:

- Fully aligned with Dutch regulations and Wtt 2018

All onboarding, monitoring, and review processes are now mapped directly to the requirements of Dutch Wtt 2018 and AML guidelines. This ensures that every client file, transaction record, and risk assessment is automatically compliant with current legislation and easy to adapt to future changes.

- Complete 100% audit trail coverage for all client files and transactions

Every submission, review, approval, and document upload is timestamped and traceable. This provides regulators and internal auditors with a single source of truth for the entire compliance lifecycle — eliminating the risk of lost or inconsistent records.

- Onboarding and reviews completed in days, not weeks

By replacing email chains, manual tracking, and spreadsheets with smart forms and automated workflows, Kiltoprak has reduced the turnaround time for new client onboarding and periodic reviews from several weeks to just a few days.

- Real-time alerts for PEP/sanction matches

Integrated AML/PEP screening means compliance officers are immediately notified when a client, UBO, or transaction triggers a hit. This allows rapid response to potential risks rather than waiting for periodic batch checks.

- Unified compliance platform across Amsterdam, Zurich, and Valletta

All three Kiltoprak offices now operate on the same platform, using identical workflows, risk rules, and reporting standards. This has eliminated regional inconsistencies and given management a consolidated view of compliance performance across jurisdictions.

- Always inspection-ready with structured and exportable reports

With every action logged and every file version-controlled, Kiltoprak can generate on-demand reports for regulators or internal audits. The platform’s structured data model ensures reports are consistent, complete, and exportable at the click of a button.

Thanks to

Emakin, Kiltoprak has turned compliance from a reactive, time-consuming burden into a

proactive, transparent, and scalable operation. The company is now equipped to handle growth, regulatory change, and external scrutiny with confidence.

Discover how Emakin can transform your business processes.